On February 29th 2017 Mitch was awarded 1st Runner-Up at the Insurance Canada Technology Awards (ICTA) ceremony in Toronto, ON. for the Insurance Chatbot on our website to service customers.

The Insurance Canada Technology Awards, highlight and celebrate the use of technologies that impact insurance.

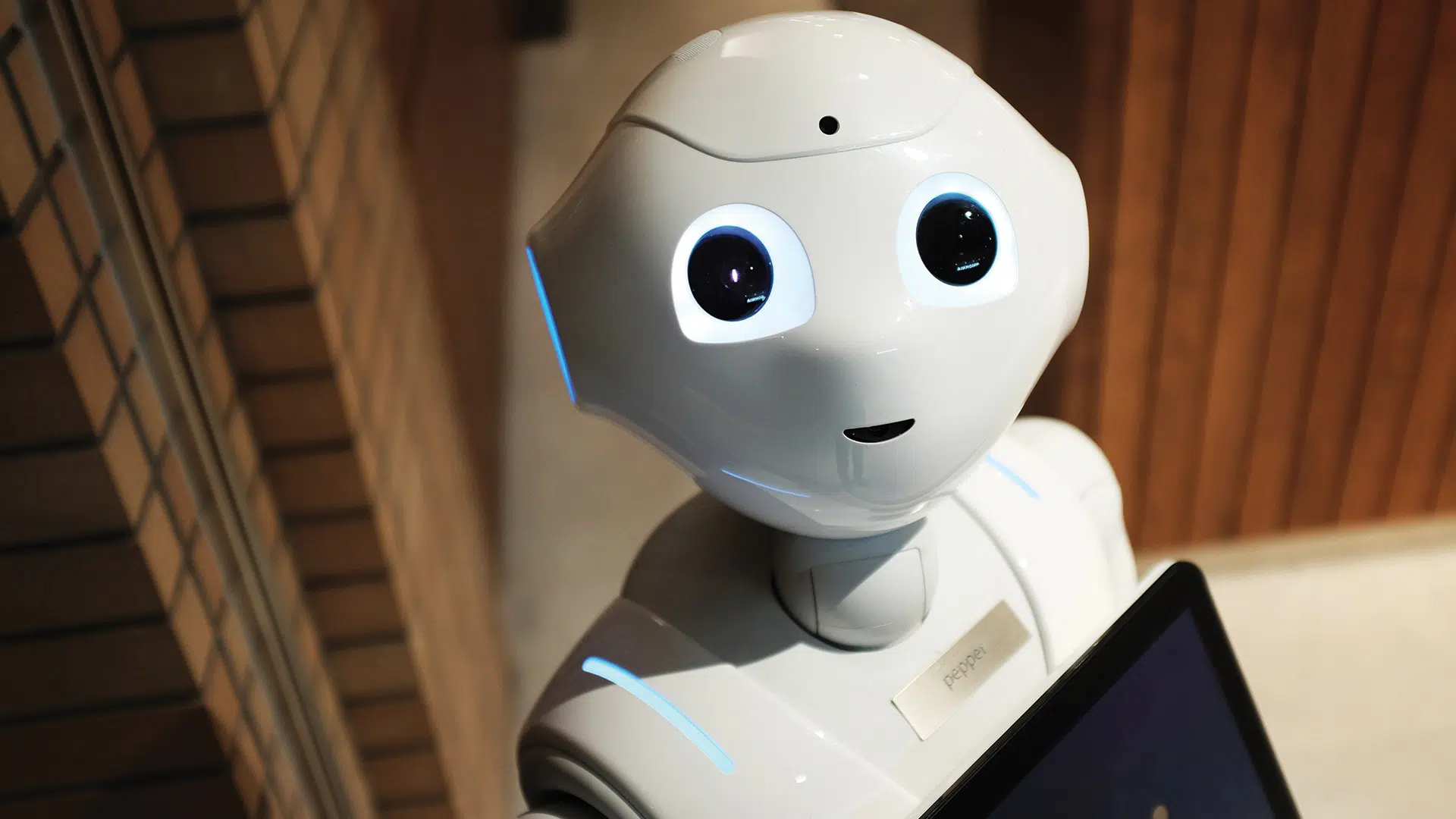

Chatbots: Connecting AI and customer service

On March 1st, 2017 Mitch presented their experience with the Chatbot to industry peers at the Insurance Canada Broker Forum (ICBF2017) in Toronto, ON.

The Chatbot can give a quote, take an insurance claim, set up a call, take a change request and a growing number of service calls.

Disclosure – we’re not the expert, we are learning right along with the bot, but we’re sharing our learnings so far.

Let’s start by clarifying ‘what is a Chatbot’ and ‘how does it work’. A Chatbot is not to be confused with a chat feature that is available and used by many insurance brokers on their websites today that is manned by a human. A Chatbot is a service, powered by rules and sometimes artificial intelligence that you interact with via a chat interface. The service can be any number of things ranging from functional to fun, and it could live inside any major chat product, like Facebook messenger.

Before we start thinking ‘Terminator’ and the movie ‘Her’ when talking about artificial intelligence (AI), as transformative as AI is, it’s not magic. AI is simply a better way to turn data into actionable insights. AI is a blanket term used when a machine mimics cognitive functions that humans associate with other human minds, such as learning and problem solving. There is not just one type of AI, for example, the AI that detects spam in your inbox (and yes that’s AI), is machine learning, and it is totally different from the AI that can understand your voice. You might not suspect it, but AI serves millions of users every day.

Why are we interested in the building a Chatbot, when we already have phone, email, text and chat features available today? Messaging vs email and phone is a reality today. 78.7 Billion messages are sent by text, WhatsApp and Facebook messenger worldwide every day – an impressive number, given there are a total of 7.5 Billion people in the world. (That means every person is sending at least 10 messages a day). This tells us it’s a communication method that cannot be ignored. So how can we make it efficient and provide exceptional customer service? Enter Chatbot, powered by AI.

If you are scaling your business over the next 5-10 years, you’ll need to train large sums of people to follow rules. You will likely cross a point in time where computing power, performance and availability are greater than your ability to hire and train.

If you’re still not convinced, consider the impact automation has had on the number of manufacturing jobs over the last 100 years. Artificial Intelligence (AI) is going to have the same impact on white collar, front line jobs in near future.

Our insurance Chatbot is new, and it still has a long way to go, but we need to start somewhere. It’s the next step to increasing productivity and we need to get ahead of it. Getting in at the beginning offers us the chance to be part of the research and development that shapes for the future.

Our Chatbot is built using Natural Language Processing, which is a form of AI. The Natural Language Processing understands the intent of the questions or query, for example, if the question is ‘Can I get an insurance quote for my Honda?’, it knows that the customer is looking for an auto quote and will provide the response based on the specific query.

As the bot has the opportunity to have more interactions with customers, using machine learning it will learn what the most common response to specific insurance-related queries are, and start to automatically respond, but this will take millions of interactions.

It’s not perfect, and there’s still a long way to go, but ultimately our goal is to be in the game, learning the technology and tools that will move our insurance brokerage into the future.