There are many instances of fraud in our everyday lives. We are aware of instances of fraud coming at us on our computers and even now on our cell phones, and it exists on our roads as well. Insurance fraud is rampant across the country, and estimates show that it costs us more than $1 billion a year. And that adds to the cost we pay for auto insurance. They cheat and we all pay.

Did you know that according to the Chartered Professional Accountants of Canada, 34% of us have been victim to one type of fraud? Scary right? Well your best defense is being informed. While we think we are being vigilant in our everyday lives, some of the most common types of fraud involve insurance and you may be unwittingly committing some of these yourself without even knowing it.

Five common types of insurance fraud:

- Towing companies and auto repair shops that intentionally overbill insurers and drive-up costs. If you get into a collision, always contact your broker to make sure your vehicle is being taken to an approved repair facility. There are plenty of stories in the media about deceptive and illegal activities.

- Medical clinics that have you sign blank accident benefit forms, then bill insurers for services never provided, or forge the signatures of legitimate, registered and active, medical practitioners on accident benefit forms to bill insurers for services never provided. Never sign for treatment that you have not received. If you need three treatments, never sign for ten.

- Staged collisions, where a driver intentionally causes a collision with an unsuspecting driver and makes it look as if the innocent driver is at fault. If you get in a collision on the road, there is a chance you have been a victim of a fraud, and you need to know the signs. We will discuss this more later in this article.

- Policy misrepresentation where you intentionally mislead auto insurance companies by providing false information such as a different address, make or model of your vehicle. It is fraudulent because false information reduces your risk profile, which reduces costs. You may think you are saving money but the punishment will far outweigh the benefits if you get caught.

- Stolen, and unrepairable, often dangerous, vehicles are given a false VIN and then sold to unsuspecting consumers. Buy from reputable dealers and check out the Vehicle Identification Number (VIN) to make sure it is still active and legitimate. Insurance Bureau of Canada has a free online service where you can check the VIN.

Categories of fraud

Insurance fraud essentially breaks down in to two tracks, opportunistic and premeditated.

1. Opportunistic fraud

This is when someone uses a legitimate loss to make an inflated claim and obtain an unwarranted insurance payment. These situations can involve:

- Pre-collision vehicle damage that is included in an auto insurance claim

- Additional damage that is inflicted to the vehicle after a collision to increase the cost of the repairs

- A person who exaggerates injuries following a collision to collect benefits (also known as personal injury fraud). Examples include:

- Malingering injuries and extended recuperation time

- Medical services fraud involving a health care practitioner who exaggerates the severity of a patient’s legitimate injury and increases the amount billed for assessments, treatment and/or assistive devices

- Offering or accepting “free” health care treatment for an injury that is unrelated to a collision or not medically necessary

- Encouraging anyone to participate in fraudulent activity

- Misrepresenting the condition, mileage, or value of installed components of a vehicle that has been stolen

- Making a claim for property that was not actually stolen or damaged during a real vehicle theft or break-in

- Misrepresenting the facts regarding fire, water, theft or collision damages so that otherwise uninsured losses can be claimed.

2. Premeditated fraud

This type of fraud occurs when someone devises a way to claim for an insured loss event. Premeditated fraud often involves extreme action, such as:

- Causing a vehicle collision with unsuspecting drivers or staging a collision with other conspirators. One or more people then claim and collect benefits from insurance companies for non-existent injuries. This kind of fraud may also have related financial and human costs, as unsuspecting victims often suffer very real injuries.

- Making an insurance claim for an event – collision, vehicle theft, break-in, etc. – that never happened

- A health care facility charging an insurance company for medical services that were never provided

- A health care facility using a medical practitioner’s professional credentials to charge an insurance company for services that were not rendered

- Encouraging anyone to participate in fraudulent activity

- Intentionally burning a vehicle

- Falsely reporting a vehicle or its contents as damaged or stolen

- Devising a way to avoid paying insurance premiums, including:

- Reporting residency at one address when living at another

- Not reporting licensed drivers in the household, or misrepresenting primary vehicle drivers – this may occur when an inexperienced driver is the principal driver, but a parent or grandparent is reported as the principal driver on the policy

- Knowingly purchasing phony proof of insurance cards or pink slips

- Failing to report significant changes to the condition, value or use of insured vehicles – for instance, making deliveries or transporting passengers for a fee or as part of a paid service such as a daycare when a vehicle is insured only for personal use.

Staged collisions

One common form of premeditated fraud is a staged collision. Would you know the signs of a staged collision? Likely not. Has this happened to you? Our busy roads and confusion around a collision may make you unaware of what has just happened. But in recent years, law enforcement has seen an increase in these types of schemes. It is best to be aware, and to report to police if you think you have been a victim. A staged collision is no accident – it supports false auto insurance claims. A collision scenario can be mimicked regardless of the number of vehicles or occupants reported, the events reported, or the resulting damages and injuries. Examples include:

- A collision in which all vehicle occupants are aware of the scheme – if occupants were not in the vehicle at the time of impact, they are known as jump-ins

- The vehicles reportedly involved never actually collided with each other – this is known as paper fraud

- Drivers and/or passengers of other involved vehicles are innocent and unaware – this is known as a caused collision.

Organized criminal groups will always attempt to disguise staged or caused collisions and paper fraud. Fraudulent collisions may result in real but unintended serious injuries to participants, bystanders and emergency response staff. A staged auto collision can cost insurers over $100,000, and you will end up footing part of the bill. Staged collisions contribute to higher premiums. Staged auto collisions put everyone’s safety at risk. The criminals staging collisions should be punished to the full extent of the law. There are three common staged collisions:

Swoop and squat

The “Swoop and Squat” scheme involves two cars: one drives beside the victim, while the other ‘swoops’ in front of the victim car and stops suddenly, causing a rear-end collision. The first car is usually full of accomplices who will claim that they were injured even if it was only a low-speed collision, submitting fraudulent claims to the insurance company. The swoop car is usually driven by an experienced ring member, while the “squat” car is generally full of either accomplices, or victims.

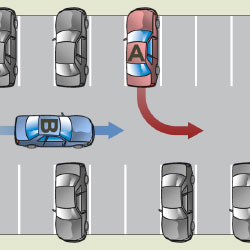

Drive down

Typically occurs in a parking lot, the “Drive Down” is when you are exiting a parking spot. A driver waves you out and then plows in to your vehicle, making it appear that you didn’t look before exiting your spot.

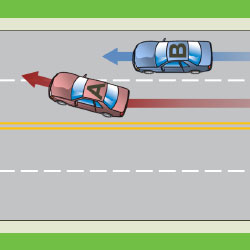

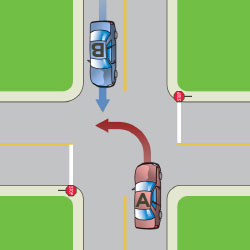

Bullet left turn

The “Bullet Left Turn” happens at an intersection when you are turning. A car coming the other way may appear to slow down or even wave you on and then drives into your car, making it appear that you have turned in to the fraudster.

Fraud costs us all

Insurance fraud costs Canadians well over a $1 billion a year in added insurance premiums, and strains our already heavily burdened health care, emergency services and courts. There are human and financial costs to insurance-related crimes, and these have a ripple effect. For example, insurance crimes such as fake accidents and falsifying insurance claims not only affect the unsuspecting victims of the collision, but also affect the general public by needlessly using up valuable law enforcement, court and health care resources that could be better used elsewhere.

Effects of fraud on society

Fraud translates into all of us paying a price in the forms of higher taxes and significantly higher insurance costs. If someone tries to tell you that insurance fraud is a victimless crime, ask that person, ‘Who pays for the police investigation? Who foots the extra-legal bills when an insurance fraud case clogs up the courts?’

| Because of fraud… | When you need it |

|---|---|

| Police have to spend time investigating fake accidents, fraud schemes and crime rings |

|

| The health care system has to assess and even treat people who don’t really need medical care |

|

| Criminal and civil courts must deal with time-consuming fraud cases, appeals and lawsuits |

|

*Source: Insurance Bureau of Canada

Get an auto insurance quote in minutes.

Tips for avoiding fraud after any collision:

- Contact your insurance company if a stranger tries to steer you to an unknown body shop, doctor, chiropractor or legal representative.

- See only medical and legal professionals you know and trust or are recommended by people you trust.

- Contact medical and legal licensing regulators in your province to ensure that your service provider is licensed and that no complaints have been lodged against that provider.

- Know what your medical benefits are, i.e., what is covered and what is not.

- Keep detailed records of your medical appointments including dates, locations, name of practitioners, diagnoses and services, as well as records of the medicine, supplies or equipment prescribed.

- Be involved in your claim. Compare your records against the statements you receive from your insurance company to make sure the bills are accurate and do not include goods or services you didn’t receive.

- Never sign any blank insurance claim forms.

- Know what your full and final settlement includes.

Reporting fraud

If you suspect insurance fraud, document your concerns. Take detailed notes of all dates and times. Save all correspondence with any service providers or other individuals you deal with. When fraud is suspected, maintaining a record of evidence can help you to prove it. Include emails, voicemails, text messages and other documentation such as:

- Estimates and invoices

- Work orders

- Medical reports

- Financial transactions and bank records

- Claim forms

- Other related information

Personal safety comes first

Avoid creating conflict or altercations when obtaining information related to a fraud situation. If you feel unsafe, insecure or intimidated at any time, call police or someone you trust. You may be in a unique position to document important information that will assist insurers and authorities in addressing concerns related to possible insurance crime.

How to record vehicle damage fraud

- If possible, take photographs of the vehicle before and after it was damaged, and take photos before and after repairs are completed.

- Include all sides of all vehicles, whether they appear to be damaged or not.

- Where it is safe, possible and practical to do so, place a measuring tape or metre stick in the photographs where damage is present.

- If you notice damage to a vehicle that appears to be unrelated to the collision, make a note of it.

- Note whether air bags were deployed in any vehicle.

- Identify and record any possible witnesses or evidence of the collision. This may include intersection or business security cameras in the area or vehicle dashboard cameras.

3 tips for tracking injury-related fraud

- Maintain a personal record of all appointments kept and the goods and services provided to you. Note any information related to your activities that might assist with reconciling events and treatment dates.

- If you are a health care provider and believe you may be a victim of health care practitioner identity theft, report your concerns to your professional college or association and/or Health Claims for Auto Insurers (HCAI).

- If you live in Ontario, you can anonymously report injury-related insurance fraud to the Financial Services Regulatory Authority of Ontario (FSRA).

Take the time. Report the crime

Help catch fraudsters. If you have witnessed or have information about a potential crime, you can:

- Speak with your insurance rep immediately after a collision

- File a report with local police or call Crime Stoppers at 1-800-222-TIPS (8477)

- Make an anonymous call 24/7 to 1-877-IBC-TIPS (422-8477)

- Notify the Canadian Anti-Fraud Centre

- Consider consulting with legal counsel

Looking for car insurance?

Speak with a Mitch Insurance broker today to get a quote on Ontario auto insurance.

Call now

1-800-731-2228