How insurers calculate the cost of your business insurance

How much is business insurance? The shortest answer to this question is that the cost to insure your business can be as low as $200 a year, or over $200,000 – depending on what your company does and how.

Contents

We appreciate that the short answer might not be too helpful, so we wanted to take this opportunity to look at the factors that can influence your premium and help you understand how your business will be viewed by Canadian insurers when deciding how much premium you should pay.

1. The basics of setting business insurance rates

A) Predicting your potential for making claims

Before we get into too much detail about your business, we thought it would be helpful to put some basic building blocks in place, which will help you to understand how insurers will determine the right premium for your business.

Expected frequency and severity of claims

Insurance companies have the very difficult job of predicting the likely amount of any claims they will need to pay if they insure you (a predicted loss cost). This is made up of two factors:

- Claims frequency – The likelihood that you will make a claim, which is called frequency

- Claims severity – The likely amount of that claim if you were to make it, which the industry calls severity

To give an example, the insurer might assume that there is a 5% chance that you will make a claim – this means that 1 in 20 businesses similar to you will make a claim in any given year. They might also assume that the total cost of this claim, if you were to make it, will be $20,000. This means that in all probability, your business will cost the insurance company 5% x $20,000 = $1,000 in claims in any given year.

Of course, in reality it never works out like this because you can’t make 5% of a claim. You will most likely be one of the 19 out of 20 companies that doesn’t make a claim that year (hooray!), in which case you might be questioning where all of your insurance premium is going. On the other hand, you might be the unlucky 1 out of 20 companies that does experience a substantial loss, and be grateful that you have been paying a relatively modest premium in exchange for the much larger claims payment. This principle of mutuality sits at the cornerstone of insurance – a group of similar customers paying their premiums into a pool to protect those who are unlucky enough to have a loss which could have theoretically happened to any of them.

How insurers predict claims potential

How does the insurance company make its bold predictions about your likely claims costs? The answer is data and experience. When you apply for your insurance, you are typically asked a number of questions about your business, e.g. what you do, your revenues, your office location etc. Insurance companies are also insuring tens or hundreds of thousands of other businesses and have this same essential information about each of them built up over a number of years. They use various statistical methods on this data to identify all of the attributes which make you more or less likely to have a claim, and to understand the likely size of those claims. In short, they look at everything that has happened in the past, and use that information to predict as scientifically as possible what might happen in the future. They will also layer on other assumptions in an effort to make their historic view more future-proofed – for example, the cost of inflation, future prices of key materials such as steel, labour costs or even foreign exchange rates (for when they need to pay claims in foreign currencies such as the US Dollar).

To bring this to life, let’s say you own the building from which your company operates. You need to insure this building for things like fire and water damage with a Commercial Property insurance policy. Your insurer will ask, amongst other things, what your property is constructed of, from which there are typically half-a-dozen options to choose from. From all of its historic data, the insurer will have calculated how each construction option has affected all of its other customers in terms of the probability of them making a claim, and also how much that claim actually cost. It has used that data to create relative pricing calculations (e.g. construction ‘type A’ will cost 20% more in claims than construction ‘type B’ and used this in calculating your premium.

There are many factors such as this which have been statistically calculated from the insurer’s data, which are considered as a part of calculating the premium for your business.

Is this approach perfect?

Interestingly, this approach is not perfect for any insurer. The quality of their older (historic) data is likely to be less robust than what they are collecting today. They might simply not have enough data to make meaningful calculations. Especially when they try to drill down into very specific attributes of the businesses they are insuring, this might mean they are making calculations on much smaller groups of customers, and the margin for error is far higher. Their assumptions on what their historic data is telling them might be unfounded, leading to flaws in its interpretation. Equally, their assumptions on various economic and other trends which are driving their predictions could be inaccurate.

In these cases, insurers also rely heavily on the many years of experience in their teams regarding the underwriting of businesses such as yours. What types of claims have happened in the past? What caused them (insurers will have many experts on their staff who have built an in-depth knowledge of what triggered certain types of claims)? Are there any specific attributes of a business that insurers should pay more (or less) attention to? This level of personal experience is a key ingredient in how insurers will decide whether or not to insure certain businesses and at what price.

B) What else is involved?

Once the insurer has predicted your businesses’ potential for making claims (frequency and severity), it then needs to calculate a premium that is adequate to pay for this and a few other important things:

- Its own operating expenses – there are a lot of moving parts inside an insurance company and they employ thousands of people to do things like pay claims, set their pricing, create better products etc.

- Insurance broker commissions – as an insurance broker ourselves, Mitch never hides the fact that a commission is paid to us on every policy we sell. That amount varies depending on the type of insurance policy you buy, and this covers the cost of providing you with a great service as efficiently as possible.

- Marketing – some insurance companies sell their products directly to individuals and businesses without a broker. You could therefore be mistaken for thinking that you could cut out all of the commissions that are paid to brokers and save big time on your premium. Unfortunately, the money that direct insurers save on broker commission is usually spent instead on advertising and sales costs. Those TV commercials don’t come cheap!

- Reinsurance – insurance companies are themselves insured in case of catastrophic losses. This not only protects them, but also protects you as a customer to ensure that they remain solvent and can pay your claim in extreme scenarios.

- Profit margin – the majority of insurers are shareholder owned, and similar to any other company, they are expected to return a profit on their investment. In addition, and in the case of mutual insurance companies (owned by their members), this profitability also creates a very important buffer for years when claims activity spikes due to a storm, flood or forest fire. If an insurance company is only profitable in the very best years, then it will lose substantial amounts of money in other years. This is not sustainable.

- Insurance premium tax – charged on all insurance premiums that you pay. The current rate of tax on insurance premiums in Ontario is 8%, and can vary from province to province.

The cost of each of these factors could vary depending on what type of insurance you are buying, and insurers will try to allocate these costs as accurately as possible.

In the simplest terms, these items are treated like a retailer’s ‘mark up’ to get to a final premium. The insurer takes your predicted claims costs, adds on their operating costs, broker commissions, reinsurance, profit margin, taxes and… voila… you get your quote!

2. Factors that will affect your business insurance premium

The following is a list of factors that can affect your business insurance premium. We’ll come back to each one of them later on to dig in deeper.

- What your business does – the specific products or services that you and your employees offer

- Your experience in your profession, including whether or not you have made any claims in recent years

- Business assets – The value, age and type of assets owned by your business or those for which you are legally liable, e.g. leased property

- Your revenues and number of employees is an important factor

- Where your business operates – the physical location of your operations and where your products or services are sold

- How much coverage – The level of insurance protection you wish to buy, including policy limits, deductibles and specific coverages purchased

- Use of business vehicles – Whether you or your employees use autos or trucks as a part of your business operations

- Exposure to natural disasters – threats that could be outside of your control, e.g. earthquakes, floods, forest fires

- The market cycle – how the insurance market is performing in general

- How you shop for your insurance

A) What does your business do?

The products and services that your company provides has a substantial impact on your insurance premium. This is because insurers will consider what you do in their evaluation of the types of claims that could occur and how frequent and large they could be. What you do will also impact the type of insurance you need to purchase, which can add to or reduce your costs.

Let’s compare two retailers as an example. Both sell products online on Amazon. One of them sells teething rings for babies, the other sells baseball caps. It’s fairly easy to see why the sales of baby products are far riskier than baseball caps. Whilst the retailer selling baby products might have far higher quality control standards, the reality is that if something were to go wrong, the potential for a multi-million dollar lawsuit is much higher with baby products than it is with baseball caps. Given your liability insurance is designed to defend you against these lawsuits, the difference between the two products is reflected in your premiums. Assuming there’s no other differences between these companies, the one with the higher risk products can expect to pay substantially more than a similar company selling lower risk products.

Now let’s take this example further and assume we’re looking at two retailers of teething rings for babies. They both sell on Amazon – but one sells exclusively in Canada on amazon.ca whilst the other sells the majority in the USA on amazon.com. In both cases, the likelihood of product failure is the same – but this difference in territory can have a big effect on premiums. It’s a well-known fact that the USA is a more litigious culture – and therefore you are more likely to be sued than in Canada. So, it’s more likely that the insurance company will receive a claim (frequency) at some point if you’re selling products in the USA. To add insult to injury (pun intended), the lawsuit in the USA is likely to cost more than the lawsuit in Canada. This is driven by a number of factors, including the cost of lawyers, the potential for a higher award of damages in the USA, and the higher exchange rate of the US dollar. In addition, you’re a Canadian company being sued on US soil – you don’t have home court advantage. This adds to the reasons why an insurer will expect to pay more in claims if you sell in the US. Selling the majority of your products and services in the USA compared with Canada can add to your premium.

Let’s take this example even further and now assume we have two retailers, both selling baby products equally in Canada and the USA. However, one sells exclusively online on Amazon, Kijiji etc. and the other one has diversified sales across its own website, Amazon, and has recently opened its first bricks and mortar store in Whitby, Ontario. The second business sells the same amount of the same goods, but has increased risks which need to be insured. For example, the presence of a store means that you will have customers physically at your premises who could slip or trip and be injured. Your store presence also means that there is an increased risk of crime, e.g. shoplifting or burglary. You will also have fixtures and fittings which need to be replaced if there is a fire or water leak, and a legal obligation to your landlord if you are at fault for the property damage and your premises is leased. If you are unable to operate at your premises due to the property damage, you could incur substantial losses from this interruption to your business.

The nature and extent of your business’ online presence also factors into the cost of insurance. If you sell online via your website, this brings increased exposure to losses related to cyber crime – where hackers could disrupt trading through infiltration of your website. If you have a large presence on social media, this also exposes your business to lawsuits related to what you do and say on these platforms.

These examples demonstrate that just some fairly minor differences in how your company operates can have a big effect on how insurers will look at your business when determining how much to charge.

You can now think of this on a broader scale, with millions of comparisons… the risk of a cardiovascular surgeon vs. a general practitioner doctor. The risk of a plumber vs. a painter. The risk of a software engineer developing games vs. one who writes code for air traffic control. A manufacturer making components for TVs vs. one who makes safety critical parts for the auto industry. Precisely what you and your business do is understandably a vital component in an insurer’s prediction of your potential future claims costs.

B) Your experience and claims history

We’ve already established that what you do is vitally important in calculating your insurance premium. It’s just as important to understand how you conduct your business and your relative level of experience.

If you are new in business, then perhaps you do not have the same level of experience as someone who has been doing similar things for 20+ years. This lack of experience can lead to mistakes (we all make them!) which you will learn from. If you are in the first couple of years of your business, you may be able to relate to the insane amount of work it takes to get things up and running and the frantic efforts involved in setting your business up for future success. Whilst understandable, it also means that you may not have had the time to put in place the various risk management practices that will eventually be commonplace in your business. If you are in the first year of your business, you might expect to pay more than a similar business with 5 years or more of experience. The extent of this increase will depend on the importance of experience relative to what your business does. If it’s your first time opening a restaurant, your premium will be extremely high. If you’re starting an HR consultancy, increases will be more reasonable.

If you have been in business for a number of years, then an insurance company will be very interested in knowing about any claims that you’ve made. Usually they will ask you to tell them about any claims in the last 5 years. Statistically, businesses that have made claims in the past are more likely to make claims in the future. Sometimes it can be just bad luck, and other times it can be an indication of something in your business that could be of concern to an insurer. For example, if you are a plumber and have had 2 claims in the last 2 years for damage to properties that you have worked on due to water leaks, an insurer will probably see this as an indication of your risk management practices and ask for a substantially higher premium.

Insurers will also want to know that you have other sensible practices and approaches in place which will minimise the risk of loss. For example, how often you clean the extractor vent in a restaurant, will indicate the way that you run your restaurant and take steps to avoid any losses.

C) The assets you own or are legally liable for

In addition to their liabilities, most businesses will choose to insure the physical things that they own or things that they are legally liable for.

Perhaps the most obvious example of this is a building that is owned by your business. You will want to buy a commercial property insurance policy that covers you in the unfortunate event that your building is damaged by fire, water or myriad other causes. Simply put, the characteristics of this building will determine how much your policy will cost. Whilst some characteristics are more important than others, here’s a rundown on the key elements:

- The age of the property – an older building is more likely to experience a loss, especially from things like water leaks, due to older plumbing and leaks from older roofs.

- What your property is constructed of – walls, floors, heating, plumbing and wiring are all key elements which can be used by insurers to predict the likelihood of you making a claim. Some characteristics, e.g. wooden frame construction, can lead to a greater chance that a small fire can spread and cause substantial damage. Aluminum wiring is also prone to causing fire.

- The size of your property in terms of square footage and its number of storeys will drive up the likely cost to rebuild in the event of a loss.

- The general use of your property will be a major factor affecting what you pay for your insurance. Residential uses, e.g. apartments, create a very different profile of risk than factories which create food products. Strip malls have a different risk profile than office buildings etc. Sometimes, it also matters which other businesses occupy your building, as insurers will reflect the risks of these tenants when considering what to charge you.

- If your property is entirely sprinklered then insurers will feel more comfortable that the risk of a fire is reduced. Likewise, if you have a burglar alarm that is wired into a central security station, your risk of crime will be reduced.

- The extent to which your property has been updated over the years. Old plumbing is more likely to leak or burst, and old roofs will have greater vulnerabilities.

- The value of any equipment, stock and contents at your properties, together with the cost of fixed signage etc.

Get a business insurance quote in minutes.

D) Size matters – your revenues and number of employees

Perhaps this goes without saying, but the size of your company will have a substantial bearing on the amount you pay for your insurance. The rationale for this is pretty straightforward: your revenues or number of employees will directly affect the likelihood of a claim occurring because your business has a greater exposure to risk.

If you are a contractor with $100,000 invoiced per year, then an insurer will be able to approximate how many physical jobs you are doing each year and set a price for this. If you have revenues of $800,000, then your company is undertaking substantially more jobs which increases the probability of a claim arising.

The same can be said of many different businesses. Manufacturers with outputs of $20 million will have a larger exposure than manufacturers of similar products with outputs of $2 million. You could apply the same logic to management consultants, software developers, architects and dentists, to name but a select few.

In some instances, the number of employees can be a similarly relevant indicator of how much risk an insurer is taking on. Alternatively, the number of electronic client records you are holding can be a good indicator of your exposure to cyber crime and hacking when setting a price for cyber insurance.

Of course, it’s great news if your business is growing and creating jobs. You should just be aware that as it grows, its risk exposure is also growing and your insurance premium will grow in proportion to that.

E) Where your business operates

As they say in real estate: it’s all about “location, location, location”. This matters in insurance too, and the physical location of your operations and where your products and services are sold has a big impact on your insurance premium.

Location of your property

First, let’s take a look at the physical location of your operations, particularly if you own and operate out of a property. Insurance companies will take this into account because Canada is a very diverse country geographically, and your precise location can affect the likelihood and types of claims that could happen. Here are some examples:

- Proximity to hydrant or fire hall – Potentially the most important factor is the level of protection that your property will benefit from in the event of a fire. This is why insurers will often ask, or have data that tells them, how close your property is to a fire hydrant, or the distance to the nearest fire hall. The quicker your property can be reached in the event of a fire, the less damage is likely to be caused.

- Potential for damage from natural disasters – If your business is located next to an unprotected river, then it may be far more susceptible to damage by flooding. The same could be said for the risk of earthquake, forest fire, windstorm or hail, depending on your precise location. Insurers will have models which predict how likely these things are to happen to your business.

- Crime rate – Retailers, offices or manufacturers in major urban areas may be more exposed to crime and vandalism than those in the countryside, and this risk can be plotted across the country. Insurers will use crime maps to establish the risk for your business.

- The accessibility to your property can make a big difference in the event of a fire or other major loss – not just for firefighters, but also for the cost of removing debris and rebuilding. If your property is remote, it can cost considerably more to remove debris, transport new materials to your location and rebuild. This can be partly offset by a reduction in labour costs, which are typically lower outside of the major urban areas.

- Proximity to other high-risk businesses – Your business may operate in close proximity to a different, high hazard, business. There have been notorious examples of this in recent years, such as the fireworks factory explosion in China causing widespread damage across the city of Tianjin, and insurers will look to identify whether you are close to any similarly risky exposures in your location such as gas stations. To a smaller extent, being in the same building as a restaurant will have a negative effect on your insurance in today’s market.

Where your products or services are sold

In the section about ‘What does your business do’ we broadly covered how the location where your products and services are sold can also affect your insurance premium. The example we used to illustrate this was whether your products are sold in the USA or in Canada, which can lead to differences in your likelihood to be sued and the expected cost of legal defence and damages.

The same can apply across Canada, reflecting the differences in legal frameworks across the provinces. One example of this relates to host liquor liability – a type of insurance that protects bars and restaurants against any risks associated with their sale of liquor to the public. If the patron of a bar gets in their car and drives home, then the bar could be found partially to blame for any resulting accidents or damage that occurs (depending on a whole bunch of factors). The extent to which a Court of Law might apportion blame can differ from province to province, and insurers will take this into account when determining their price for this type of insurance.

F) How much coverage do you wish to buy?

When it comes to insuring your business, you can usually make some key decisions around how much insurance you want to buy, which will ultimately affect how much you pay. Be careful though. As with most things, you often get what you pay for, and if it sounds too cheap, that may be because you are missing key coverages.

Getting the right limits

The first element under your control is around the insurance limits you choose to buy. This limit represents the maximum amount that an insurer will pay for a claim relating to any particular part of your business insurance. Your insurance policy will likely have different limits for different coverages, for example, your property limits should reflect the cost of rebuilding or replacing any property, tools, equipment or business contents owned by your company. Meanwhile, your liability limits will be driven by the amount of protection you want to buy in the event of being sued. They can often be dictated to you by your customers, who might demand that you hold a certain limit of insurance.

It may be very tempting to reduce the cost of your insurance by reducing the limit of insurance you are buying, but as you might expect, this can often end in tragedy. Perhaps most importantly, most property insurance policies will contain what is known as a ‘co-insurance clause’. This means that if you make a property claim, the insurer will determine if your property was adequately insured and if not, they will reduce any settlement accordingly. Even if the cost of the damage is less than your limit of insurance, an insurance company may reduce the value of settlement to the extent to which your property is under-insured. Don’t worry – there’s usually a buffer of at least 10% (sometimes more) to account for general difficulties in properly assessing the rebuild cost of your property (this will be stated in your documents as the value of the co-insurance clause). However, if you choose to insure your property for an amount substantially lower than its true rebuild cost, then your insurer can proportionately reduce any claims settlements.

When it comes to buying liability insurance, it’s a little trickier to figure out what limits you might need.

Unfortunately, there’s no limit to the damages a court could award to a third party as the result of an error or accident that you or your employees might be found responsible for. So, as a general rule, the greater the limit, the better you will sleep at night. For example, if a third party is awarded damages of $2.5 million as a result of a fire that one of your employees caused at their property when fitting some new piping, we’re guessing that your business would be in substantial trouble if you only purchased $1 million of general liability coverage. The general trend is that court awards increase over time, and that $1 million of insurance coverage does not go as far as it used to. It won’t cost much more to start your thinking at $2 million so we would recommend this as a minimum, and then increase from there based on your exposure.

Our best advice here is to discuss with an expert insurance broker who can take you through the process of determining what limits of insurance you need.

Getting the right product coverages

There is a really wide range of insurance products in the market today. The types of things they cover can also vary wildly, and nobody wants to buy insurance coverage they don’t need. So, how can you decide what insurance you do and don’t need for your business?

The possibilities are too many to list here, but here are some of the more common options you can consider when determining how much coverage your business needs:

- Property insurances can appear similar on the surface, but you have some key choices here. Perhaps most importantly, the basis on your business contents, tools or equipment will be settled if they are lost or damaged as part of a valid claim. There are two options here: the first is replacement cost which means that your property will be replaced as new regardless of its age or condition. The alternative is called actual cash value in which case the insurer will settle for the current estimated value of your contents, tools, equipment etc. based on their current age and condition. Naturally, you can save some money by purchasing an actual cash value policy, but may not be able to adequately replace your contents in the event of a loss.

- Another important property consideration is the basis for your property insurance. There are essentially two types of commercial property insurance with the industry terms ‘broad form’ or ‘named perils’. A named perils policy works by listing out the specific things your property is insured against. This typically includes Fire, Explosion, Escape of Water, Aircraft or Vehicle Impact, Lightning, Smoke, Windstorm, Theft and Falling Objects. In short, if it’s not listed, it’s not covered. On the other hand, a broad form policy insures your property against anything – unless it’s specifically listed as an exclusion. As a result, a broad form policy provides additional coverage and increased peace of mind. The premium for a named perils policy will typically be cheaper than for a broad form, but we would always recommend buying that additional peace of mind when it’s offered.

- Most businesses will hold Commercial General Liability insurance (often known as CGL), but may not be aware that these policies are designed to chiefly cover your business if it is sued for property damage or bodily injury caused to a third party. However, if your business provides services which could cause a financial loss to a third party, for example an architect, consultant, investment advisor, sonographer, lawyer etc. then you need to consider Errors & Omissions insurance (often known as E&O). This insurance is designed to cover professionals who cause financial loss to another party as a result of an error or omission arising out of their services.

- If you have employees who are not covered under the Workplace Safety and Insurance Board (WSIB) then you should definitely consider purchasing Employee Liability insurance which covers you if your employees suffer bodily injury in the course of their duties.

- The majority of business are exposed to crime – both from within (e.g. employee dishonesty) and from outside (e.g. burglary). A crime insurance policy can typically be added to your insurance package to protect a broad range of crime scenarios. One important point to note is that a crime insurance policy will not cover cyber crime (e.g. hackers) and you will need to buy a different coverage for this.

- If your business deals with hazardous substances that could potentially contaminate land, water or air, then you will want to consider an Environmental (or Pollution) liability policy. Your General Liability insurance will not cover you for this.

- Products Liability can be added to your general liability policy and will be needed if your company makes or sells a physical product which can cause bodily injury or property damage to others. In these circumstances, it’s really important to check whether your General Liability policy includes this coverage.

- The majority of your liability insurances are there to protect you in the event that your business is sued by a third party. However, what about when things are the other way around? When your business is wronged by someone else and you need to take legal action or get legal advice? Legal Expense Insurance is an underrated product in Canada that can provide advice and help you take legal action in the case of employee disputes, contract disputes, debt recovery, protecting your property, and protecting any statutory licenses. Our prediction is that this type of insurance will increasingly be included in standard business insurance packages at a fairly modest cost.

- If your property suffers an insured loss, e.g. a fire, and is unable to operate normally for a period of time, you will want to benefit from Business Interruption insurance which can replace your earnings or profits until such time that your business is back up and running (or you reach a maximum time period for the policy). Business Interruption insurance can also provide what is known as Extra Expense coverage, which pays for additional non-typical expenses your business incurs in an effort to get your business running, e.g. renting additional office space or equipment, overtime costs etc.

- Cyber insurance is a relatively new type of insurance that you may want to consider if your business is reliant on technology to operate, or if you hold client information that could be considered private. In this world of increased regulation around any loss of private information, and where hackers are more active than ever, it can make great sense to include this type of insurance in your package. Cyber insurance not only covers your liabilities and costs associated with a breach of private information (including any regulatory fines), but also covers the costs to your own systems and business from any cyber crime, such as ransomware, phishing, social engineering etc.

There are many more insurance options you may want to consider depending on what your business does. As always, if in doubt, we recommend you speak with a licensed insurance broker to get the lowdown.

Insuring yourself

The final piece of the puzzle under your control is around how much risk you want to take as a business in the event of a loss. In essence, this is a decision, perhaps subconsciously, you are taking whenever you decline an important coverage that is being recommended to you by your broker. You are deciding to self-insure this entire risk should something bad happen.

In addition, you can sometimes choose the level of deductible that you want on your policy. You can usually save money by taking options with higher deductibles, which means that you are taking on a greater amount of cost in the event of a claim. A co-insurance clause can work similarly in setting out the percentage of any loss that you will share with the insurer.

G) Do you or your employees use vehicles as a part of your business operations?

Insurance for any autos or trucks owned and used as part of your business operations is typically treated separately from your businesses’ property and liability insurances. For most businesses, the most important question is: do I need commercial auto coverage?

As a general guide, you require commercial auto insurance if your vehicle is owned by your company and used for the purposes of transporting or delivering goods, materials, merchandise, equipment or used for business services such as transporting passengers for money.

In the case of a small number of autos or trucks, these will be individually underwritten and priced and you will also need to provide names of employees who will drive them. Where you operate a fleet of more than 5 vehicles in Ontario, you could be eligible for a Fleet insurance policy which will bring all vehicles and drivers together including additional coverages you may need such as loading / unloading, attached equipment etc.

H) Exposure to threats that could be outside of your control, e.g. earthquake, floods, forest fires

You may have noticed that in recent years there have been an increasing number of major windstorms, forest fires and natural floods. Whether you’re a believer in climate change or you put it down to a general long-term climate cycle, the numbers don’t lie. The insurance industry keeps records of “catastrophic events” and the trend is alarming. The Canadian insurance market has averaged $1 billion of insured catastrophic events every year over the last decade, and is on track to do the same this year.

The fact that insurers are able to help so many people when these terrible events happen is an amazing thing. This is ultimately what they are in business for. We might think back to catastrophic events like the Fort McMurray forest fires of 2016 or the Calgary floods of 2013, which were in the National headlines for months. These events are more common than you think. In fact, in 2019 alone, $600 million has already been earmarked by Canadian insurers for catastrophic events, including the spring floods in Ontario and Quebec.

The most simple reality of this is that these catastrophic claims need to be paid for out of all the premiums that Canadian insurance companies receive. They can’t just hide their heads in the sand and hope that these big losses don’t happen, so they need to predict how much they might have to pay in any given year, and include this in their pricing.

Not an easy task, but insurance companies do their best to make these estimates and allocate them across their customer base. This means that their customers will not all contribute the same amount towards these losses. For example, if your business is located near a river, then there’s increased likelihood of a flood, and the price of your flood insurance will reflect this. The same can be said if your business is located in or around a forest, or a major fault line in the case of earthquake. In fact, their models are extremely sophisticated (they are, after all, in the business of managing risk!) and will take all of this into account when deciding how much premium they need to charge for your insurance.

As a final point here, insurance companies are themselves insured for catastrophic events such as this. They purchase their insurance from companies called reinsurers, who insure insurers around the world. In the same way as your own business, insurers can decide how much reinsurance to buy, how much risk they want to retain themselves (similar to their deductible) and which reinsurer(s) they want to buy it from. All of these factors and more will determine the price that the reinsurer charges them for their insurance and this gets built into their own pricing model when deciding how much to charge you for your business insurance. As catastrophic events are increasing, not only in Canada, the price of reinsurance is gradually increasing.

I) The “market cycle” – how the insurance market is performing in general

What do the insurance “market cycle” and “hard market” mean?

Similar to most other services, the price of insurance can rise or fall as a result of the general dynamics of the insurance market.

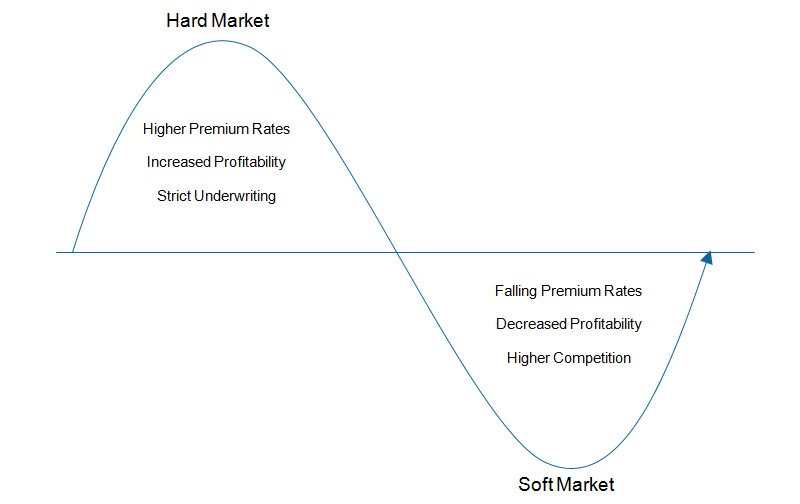

When times are good, insurers are profitable and confident and there is increasing competition in the market. This drives prices down, insurers take more risks, and we enter what is called a soft market. This usually takes the form of a gradual reduction of insurance premiums over a number of years.

On the opposite side of the coin, when times are bad, insurers are losing money, they begin to take substantially less risk, and competition withdraws from the market. Prices go up – sometimes so fast that you can get whiplash – while insurers try to restore profitability. This is known as a hard market.

This can be a surprisingly important factor in your insurance premiums, and can affect the majority of businesses, as well as home and auto insurance policyholders.

Get a business insurance quote in minutes.

Do insurance companies really lose money?

Believe it or not, the answer is yes. There are a number of factors which drive the profitability of insurance companies, which can lead to periods of substantial unprofitability.

Some of the factors which lead to a hard market, and subsequent increases in premium, include:

- Natural catastrophes: for example, forest fires, floods and windstorms can cost insurers hundreds of millions, if not billions, of dollars.

- Increasing claim costs: the cost of fixing automobiles, to give just one example, is substantially higher that it used to be, due to increased technology in newer cars, e.g. sensors in bumpers and windshields. Similar examples could be given for the cost of repairing homes and commercial property.

- Level of competition in the market: Like in any industry, healthy competition helps to bring prices down for customers. The number of insurers who will be actively competing for your insurance business increases when they believe that premiums are at a profitable level.

- Investment market returns: Insurers hold onto a portion of your premiums to pay future claims. This money is invested in things like bonds, which make a positive return for them. In times of high investment returns, this will help the insurer to absorb its losses from claims, i.e. in theory, the insurer can afford to be less profitable from its insurance because the investment returns can off-set this. Of course, in times of lower investment returns (like the last few years), insurers need to be more profitable from their insurance business and premiums tend to rise.

- General capacity in the market: this is very similar to the amount of competition in the market. Insurers need to hold a substantial amount of capital in order to write any insurance policies. This rule is in place to protect you, the customer, from a situation where the insurance company does not have the physical cash to pay claims that might happen. In times where the industry is unprofitable, it is more difficult for insurers to attract investors and raise capital and their capacity does not grow – or can even reduce in some cases.

What part of the insurance cycle are we in today?

Most observers will say that we have been in a soft market now for 15+ years. Prices have been fairly flat over that time, and in many cases, have been dropping gradually every year. Sure, there have been some fairly modest increases in premiums for auto and home insurance in recent years, but at the same time, premiums for commercial liability insurance and commercial property insurance have been gradually dropping for a number of years.

The last couple of years have not been profitable for the majority of insurers in Canada. Auto insurance in Ontario has been especially unprofitable for a number of insurers and there is a fair chance that you will see an increase in your premiums this year. The same can be said for home insurance, where increasing claims costs and a few bad storms in recent years have led to unprofitability.

Business insurance has been highly unprofitable in some areas such as trucking and transportation insurance and in the hospitality industry. Commercial property is also challenging right now for many insurers. At the same time, liability insurance for businesses such as consultants, contractors and medical professionals is more stable.

It’s important to understand that it’s very difficult for insurers to react to losses in personal auto insurance because they require approval from the provincial regulator before they are able to change their prices. This is very time consuming, and it’s by no means guaranteed that the regulator will approve the changes they want to make. However, when it comes to business insurance, the insurance companies have full control over who they insure and what price they can charge. Therefore, they are able to react much faster to change not just their pricing, but also the type of customers they want to insure.

As a result, there’s definitely less competition for many types of business insurance right now, with insurers withdrawing from products like transportation and hospitality. In this low interest rate economy, investment returns are not substantial enough to subsidize losses from underwriting.

Whilst we are not quite in what could be described as a “hard market”, there are signs that price increases are on the way and without question, insurers are all being more disciplined in who they insurer, how much coverage they offer, and at what price.

How long does a hard market last?

Our prediction is that we will not enter a full blown hard market without further catastrophic losses in Canada. Instead, we will see more of a market correction by insurers who will re-instate a strong underwriting discipline to ensure that each product line is profitable. Insurers will be content to not grow while they improve or correct their pricing to restore profitability.

Depending on what type of insurance you are buying, you can expect to see moderate premium increases over the next couple of years. We expect it to stabilize after that point as insurers will be keen to avoid a repeat of price wars which have led to their current problems.

J) How you shop for your insurance

Believe it or not, your own shopping habits and behaviours can also affect how much you pay for business insurance.

Firstly, there are hundreds (thousands actually!) of different companies willing to discuss your insurance needs and sell you a business insurance product. However, they really boil down into three main categories: independent insurance brokers, insurance agents, and direct insurers. Let’s break these down into more detail so we can understand how they operate and how they affect your insurance premium.

Independent insurance brokers

There are more than 5,000 insurance brokers across Canada, and over 1,250 in Ontario alone. They come in all shapes and sizes – ranging from small family or individually operated brokers serving a community, to global giants who have Canadian subsidiaries to serve this market. They can be incredibly different in terms of how they operate, what resources they are able to bring to their clients, and perhaps most importantly, how many insurers they represent.

Importantly, all insurance brokers are aligned in a couple of critical ways:

- Firstly, every insurance brokerage is provincially licensed and strictly monitored against a set of rules they need to follow in order to protect their customers. Further still, every employee who deals with customers will be individually licensed and personally held accountable for the quality of the service they provide. These individually licensed insurance brokers are required to take courses every year to make sure their skills are kept up-to-date.

- Secondly, insurance brokerages really do work for you – not the insurance company. Their job is to understand your needs, give you the right advice, and use their resources and professional judgement to find the best solution in the market for you and your business. This applies when you first buy your insurance, but can also apply at renewal. For example, if your current insurer decides to substantially increase your price, or that they no longer want to insure your business, your broker is usually able to help you find other options in the market and switch to a better solution.

Insurance brokers, therefore, bring substantial benefits in terms of choice and advice, which can last for a number of years. Crucially, they can help you find the right insurance at the best price and keep it as stable as possible over time.

This is perhaps most important when it comes to business insurance, which can be complicated and extremely diverse in relation to the appetites and pricing of each individual insurance company. You will need someone out there who can ensure that your key business risks are covered, even as individual insurance companies may really want your business one year, but much less the next.

Of course, the question of how to choose your insurance broker is really key for a number of reasons. We’ll save that topic for another day, but at a high level, the most important things you need to check are as follows:

- Are they truly independent, or owned by an insurance company? Believe it or not, some insurance brokers are owned (either partly or in whole) by insurance companies. The biggest example of this is Canada BrokerLink who are owned by Intact Financial Corporation. This is not directly a bad thing. They will give you quotes from other insurers that they represent, but you may question how independent they really are.

- How many insurers do they represent? Surprisingly, insurers can be very picky when choosing which insurance brokers to work with. It’s highly unlikely that any insurance broker will represent every insurance company in your province, and actually it’s far more likely that your broker will only represent a relatively small handful of insurers. Therefore, make sure you ask how many insurers will be consulted when dealing with your insurance broker (as a guideline, Mitch can shop from 70+ insurers).

- What level of service do they provide? This is really a matter of personal choice, but how do you want to interact with your insurance broker and how do you expect them to serve you? Do you need them to be open longer than just 9am to 5pm? Do you want to be able to drop in to their office in person or deal with them on the phone? Do you want them to get involved if you have a claim and need support with your insurer? Do you want the convenience of being able to make minor changes to your account online, and sign documents electronically, or do you want to have physical paperwork that you can file away for when the need arises?

Whatever your personal preferences, there will be a broker in that shape or size, so it’s important to ask your questions up front and make the right choices.

Insurance Agents

Insurance agents are professionals who are employed by an insurance company to sell that insurer’s products, typically in your local community. Desjardins, AllState and Co-operators are all good examples of insurance companies that sell through their own agents.

Similar to insurance brokers, agents are professionally licensed and must maintain a standard of knowledge in order to provide the right information and advice to their clients.

Unlike insurance brokers, agents are directly paid and commissioned for sales on behalf of the insurance company that owns them. They are therefore extremely knowledgeable about the products, services and procedures of that insurance company. If your type of business fits nicely into their appetite then you can sometimes find reasonably priced insurance from an agent.

Of course, with these strengths come limitations. Especially in the case of business insurance, a lack of choice is not a good thing because individual insurer’s prices can vary substantially. Their prices can also change from year to year, so what might seem like a good deal when you first engage, might not be such a good deal in one or two years’ time. Insurance agents are restricted in what they can do to help you in these circumstances, as they are unable to discuss or sell any other insurer’s product.

The other element to check, particularly in the case of business insurance, is that agent’s ability to sell you all the different coverages you need for your business. Business insurance can sometimes be very complicated, depending on your individual activities, and can require very specialized coverages. Any given insurer might have robust coverage for some of your business’ exposures, eg. general liability, but very poor coverage for others, eg. cyber and data breach insurance, product recall or environmental insurance. An insurance agent could be restricted in its ability to find the right coverages, or worse still, might sell you inferior products which leave you exposed in the event of a claim.

Direct insurers

Direct insurers are very similar to insurance agents. Essentially, they are insurance companies selling you their own products and services, typically over the phone or on the web.

There are a few prominent direct insurers in Canada, including Belair Direct (owned by Intact), Sonnet (owned by Economical) and TD Insurance (owned by TD Bank).

Direct insurers can bring certain benefits to their clients. They are generally better at developing their products online because they ultimately own the product and don’t need to account for differences amongst other insurer’s products. Their call centres are also likely to be open for longer hours than your average broker – although some brokers are now rising to that challenge and open for extended hours.

With these benefits come drawbacks. They are typically far less developed when it comes to business insurance, and the majority of their business will be focused on auto and home insurance. They are also unable to offer any choice beyond their own products, therefore if your business happens to fit in their target appetite, you may receive competitive pricing. However, they are not shopping around the insurance market for you to find you better deals as and when they arise.

In a very similar way to insurance agents, their products might be very robust for some aspects of your business, but very limited for others, and this is something you will need to seek advice on.

Finally, with both direct insurers and agents, it’s always good to remember that everyone you speak with works for, and is paid by, the insurance company. Sure, this may not be a big deal when you’re buying a policy, assuming you know what you are looking for, if the price is cheap. However, does this become a bigger deal if you are considering whether or not to make a claim?

What can I do about all of this?

The great news for you is that you have a lot of choice when it comes to where to buy your business insurance.

All business insurance is not created equal, so above all else, it’s important to have the right information or advice on what you’re buying, and choice across the insurance market. After all, insurance is an important purchase for your business, and flexibility is key.

During these periods of increased turbulence in pricing, our recommendation is that you speak with your insurance broker to understand your full range of options. It’s important to make sure your broker has access to a very wide range of insurers, as there will be a higher than normal variation in their premiums.

At Mitch Insurance, we have access to over 70 insurers and give all our customers the choice to look at multiple options when required.

Looking for business insurance?

Speak with a Mitch Insurance broker today to get a quote on Ontario business insurance. Learn more >

Call now

1-800-731-2228