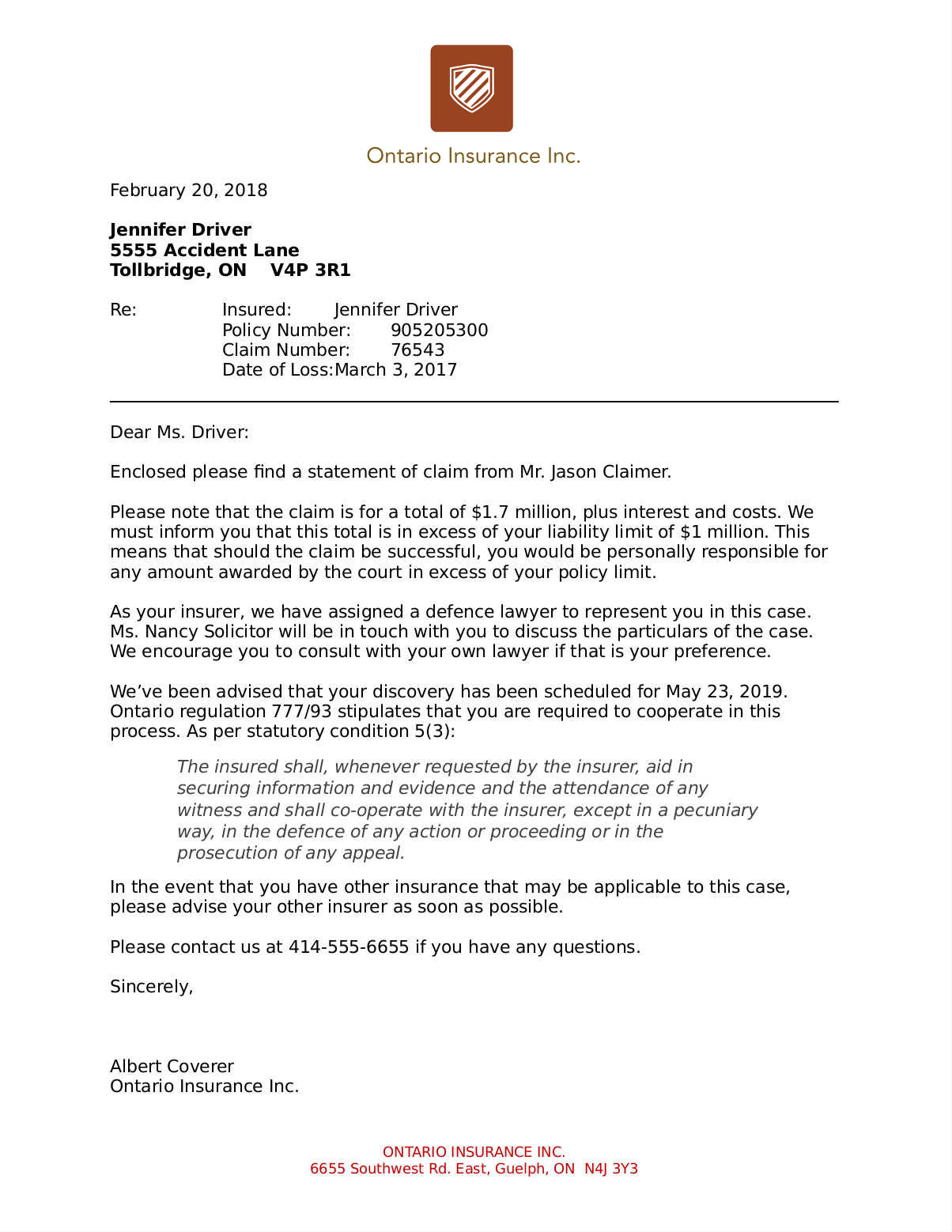

As an insurance broker, every once in a while, we get copied on a notice from an insurance company to one of our customers, letting them know that a claim has been made against them.

We are always concerned when someone has been injured, but we really hate to see letters like the one below, letting our customer know that they are being sued for MORE than their liability limit.

The letter you don’t want to get:

This is why we always recommend $2 million in third-party liability coverage.

Why $2 mil?

Auto insurance is made to protect you from the financial risks that are inherent in driving. In Ontario, regulations require every driver to have a minimum amount of no-fault coverage to help you get back on your feet after an accident. Ontario also allows victims of car accidents to sue at-fault drivers for additional losses, and every driver in the province is required to have a minimum $200,000 in third-party liability coverage, to pay for potential lawsuits.

Simply put, this limit is just not enough. Most insurance brokers will urge you to increase your liability coverage to at least $1 million. At Mitch, we strongly urge our customers to get $2 mil.

The stats don’t lie. Between 2012 and 2016 in Ontario, there were more than 6,500 auto-related lawsuits for more than $200,000 each. This is just the lawsuits that succeeded. The average payout was close to half a million. Although it’s still fairly rare for courts to award more than $2 million for a car accident, $1 million+ is becoming more and more common.

Should you increase your liability limit? – well absolutely freakin’ yes

There are two ways to think about liability limits. It’s clear that the government has decided on a Minimum limit ($200,000 per claim) that covers the majority of claims, but excludes the largest. That’s one way to go. But if you were one of the 6,500 Ontarians, 18 people every day, who were sued for more than $200,000, and you didn’t have additional liability coverage, that wouldn’t make you feel any better, and you might have to sell your house, put off your retirement, or even declare bankruptcy.

For maximum peace of mind, most Ontarians want to know that no matter what happens, they won’t have to sell their belongings or be subjected to a lifetime of debt. Given recent history and current trends in litigation, Mitch recommends protecting yourself to a limit of $2 million, or having a combined liability limit of $5 million between your home and auto insurance policies. Of course, that’s easy for us to say, given that we sell insurance, but the fact is that the additional cost to go from $200,000 to $1 million to $2 million is much less than you would think, and well worth it for the peace of mind you get in return.

Avoiding bankruptcy for the price of a scratch & win

The following numbers are based on one insurance company’s rates for one particular kind of driver, but should give you an idea of how much it costs to increase your liability limit:

| Liability limit | Monthly premium | Difference from minimum |

|---|---|---|

| $200,000 | $112 | – |

| $1 million | $127 | $15 |

| $2 million | $133 | $21 |

Essentially, you can increase your liability coverage from $1 million to $2 million for a little more than the price of a scratch & win ticket per month. If you buy that scratch ticket, your odds are about 1 in 3 million to win $100,000 (These are the odds for a $5 ticket called The Big Spin). If you bump up your liability coverage instead, you protect yourself from someone winning a much bigger jackpot…out of your pocket.

The moral of the story is that $2 million in third party liability insurance should really be the minimum coverage for most Ontarians, and given that you can go from $1 million to $2 million for about six bucks a month, this limit makes a lot of sense. All for the price of a scratch ticket.

Looking for car insurance?

Speak with a Mitch Insurance broker today to get a quote on Ontario auto insurance. Learn more >

Call now

1-800-731-2228